Seed-Strapping so với Boot-Scaling trong thời đại AI Native

Gần đây tôi đã rời khỏi công ty khởi nghiệp có doanh thu hàng năm $150 triệu Mỹ kim mà đã huy động được $200 triệu Mỹ kim từ quỹ đầu tư rủi ro và phát hiện ra một điều đáng ngạc nhiên:

Cách mà 90% nhà sáng lập xây dựng các công ty là hoàn toàn không hiệu quả.

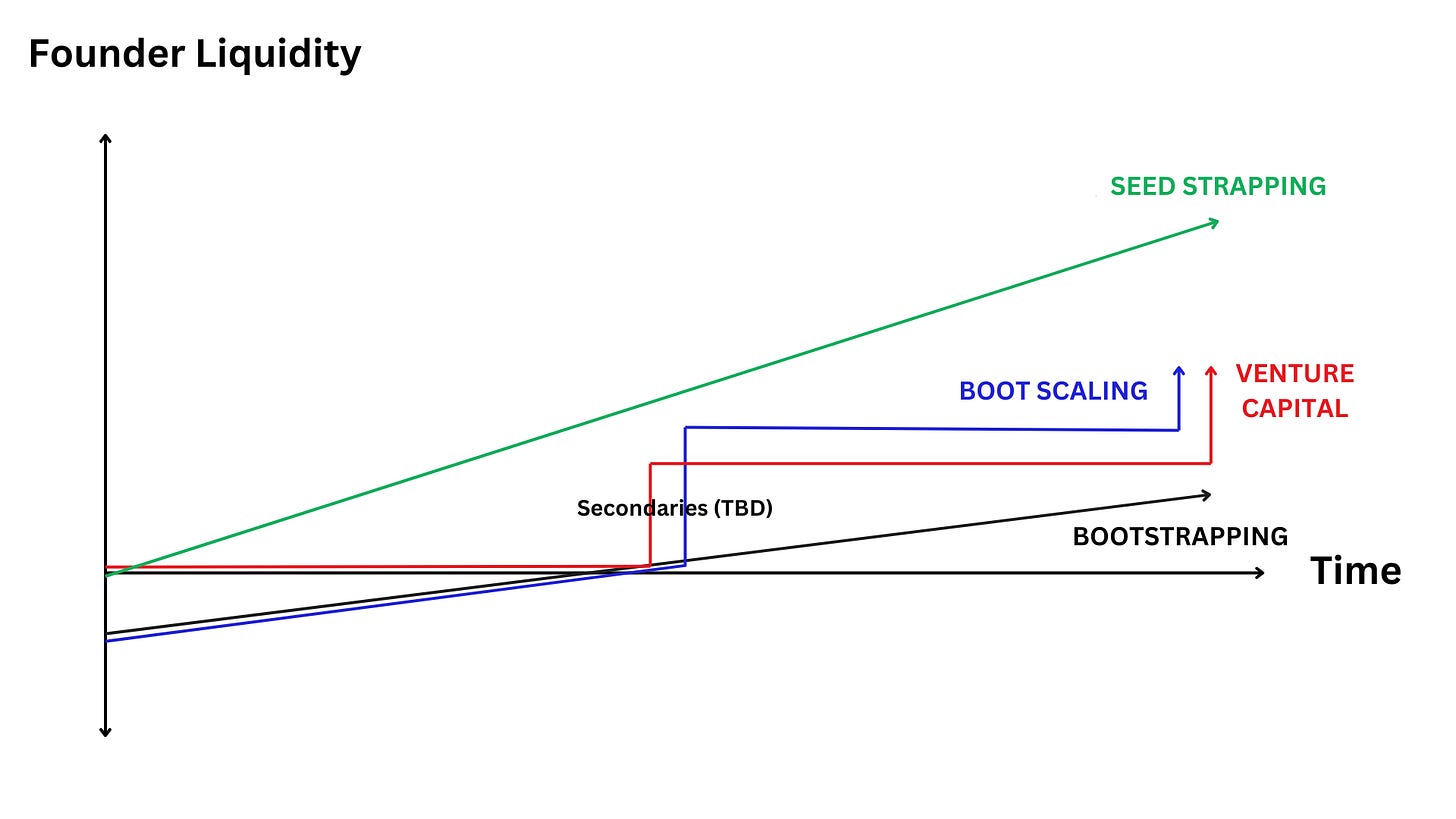

Trong nhiều thập kỷ, chúng ta đã bị mắc kẹt trong một cặp phân loại sai lầm: tự trang bị (và đấu tranh suốt nhiều năm) hoặc gọi vốn từ VC (và từ bỏ quyền kiểm soát).

Nhưng vào năm 2025, trí tuệ nhân tạo đã thay đổi mọi thứ.

Tôi thấy một cuộc cách mạng trong cách mà các công ty được xây dựng, và những người sáng tạo thông minh nhất đang tận dụng một mô hình mới mọc lên mà hầu như không ai nói về.

Đây là cái nhìn nội bộ về cả bốn phương pháp xây dựng và tài trợ cho một công ty, với các con số cứng từ chiến trường. Tôi đã tổng hợp chúng sau khi trò chuyện với 100+ người sáng lập và học hỏi từ những người sáng lập thông minh trên Bảng xếp hạng Lean AI:

Các lựa chọn truyền thống (mà đang thất bại với hầu hết các nhà sáng lập)

Tùy chọn 1: Khởi động

Bạn tự chi trả mọi thứ, hết hạn tín dụng và rút hết tiền từ tài khoản tiết kiệm.

Bạn giữ 100% quyền sở hữu nhưng đối mặt với rất nhiều thách thức:

90% các startup thất bại trong vòng 3 năm đầu tiên, và tỷ lệ thất bại còn cao hơn đối với các công ty tự tài trợ.1 8 trong số 10 công ty tự khởi nghiệp thất bại trong vòng 18 tháng do hạn chế về tiền mặt.

Tài chính cá nhân của bạn đã lỗ từ nhiều năm, không có bảo đảm về sự sống còn.

Ngay cả những người khởi nghiệp thành công cũng thường mất 5 năm trở lên để đạt được thu nhập chỉ là sáu chữ số (thậm chí sau khi làm việc 80 giờ một tuần với mức lương thấp hơn mức lương tối thiểu).

Tùy chọn 2: Vốn rủi ro

75% của các startup được hậu cần bởi quỹ đầu tư không bao giờ hoàn lại vốn cho nhà đầu tư.

Chỉ có 0.1% đạt được các lối thoát kỳ diệu chúng ta đọc được trên TechCrunch.

Tuy nhiên, mô hình buộc TẤT CẢ các người sáng lập hoạt động như họ sẽ ở trong 0.1% đó.

Các nhà sáng lập đầu hàng một phần cổ phần ở mỗi vòng: 20% ở vòng Seed, 20% ở vòng Series A, 15-20% ở vòng Series B...và cứ tiếp tục như vậy.

Bởi vòng C, những người sáng lập thông thường chỉ sở hữu 15% cổ phần của công ty, và 99% không bao giờ đạt được mốc cột này.

Một người sáng lập xây dựng một công ty 50 triệu đô la với VC thường rời khỏi với ít tài sản cá nhân hơn so với người xây dựng một công ty 10 triệu đô la thông qua bootstrapping.

Tùy chọn 3: Khởi động-Tăng cỡ

Bạn tự tài trợ cho đến khi bạn chứng minh được sự quan trọng có ý nghĩa, sau đó thực hiện một vòng tài trợ lớn (thường từ vốn riêng).

Phương pháp này bảo toàn quyền sở hữu ban đầu nhưng đi kèm với những chi phí ẩn

Bạn phải chịu đựng cuộc chiến khó khăn về tài chính khi tự cấp vốn suốt nhiều năm.

Sau đó, bạn pha loãng một cách rất lớn trong một sự kiện duy nhất (thường là 40-50% của công ty bạn). Bạn cũng mất kiểm soát để các nhà mua cổ phần tư nhân quản lý từng chi tiết, họ thường làm hỏng văn hóa của công ty.

Hồ sơ rủi ro cao: Bạn đốt hết vốn cá nhân sau đó đặt cược tất cả vào một sự kiện mở rộng duy nhất mà thất bại 72% thời gian.

Mô hình Mới (Mà Trí tuệ nhân tạo đã làm cho nó trở thành có thể)

Tùy chọn 4: Ghép cấp hạt giống AI-Native

Mô hình này là lý do tại sao tôi rất hào hứng với tương lai của việc xây dựng công ty, đặc biệt là đối với các doanh nghiệp AI-native.

Bạn huy động một vòng gọi vốn hạt giống khiêm tốn ($100K-$1MM) từ các nhà đầu tư hiểu rằng những người sáng lập thông minh nhất muốn kiểm soát và sở hữu.

Bạn tập trung vào doanh thu và lợi nhuận ngay từ ngày đầu tiên. Bạn không quan tâm đến các chỉ số vô nghĩa mà làm ấn tượng với các nhà đầu tư mạo hiểm.

Bạn tăng trưởng doanh thu mà không cần thêm sự pha loãng. Điều này giúp bạn tập trung 100% vào công việc kinh doanh của mình mà không cần lo lắng về việc cạn kiệt tiền bạc hoặc săn đuổi các nhà đầu tư.

Với trí tuệ nhân tạo làm thay đổi kinh tế của việc xây dựng công ty, bạn có thể nhanh chóng mở rộng lên mức doanh thu hàng nghìn tỷ đồng hoặc hàng chục tỷ đồng một cách nhanh chóng và có lợi nhuận (ngày càng có nhiều người sáng lập đang mở rộng các dịch vụ có tính năng AI và định giá dựa trên kết quả, điều này trước đây là không thể).

Bạn sẽ nhận một thu nhập ổn định từ lợi nhuận thay vì đợi một lối thoát huyền thoại nào đó.

Với thời gian, bạn có thể thực sự mua lại cổ phần và tăng sở hữu của mình.

Một trong những khía cạnh mạnh mẽ nhất của mô hình này là khả năng tích hợp doanh thu sớm.

Ví dụ, $100k được tích lũy ngày hôm nay với tốc độ tăng trưởng 30% YoY trong 5 năm mạnh mẽ hơn nhiều so với $100k chỉ bắt đầu tăng trưởng và tích lũy hai năm sau.

$100k x 1.3^5 = $371k

$100k x 1.3^3 = $219k

= 70% doanh thu cao hơn

Tại sao trí tuệ nhân tạo đã biến việc cài đặt hạt giống trở thành mô hình cuối cùng

Kinh tế xây dựng các công ty đã bị phá vỡ một cách cơ bản trong kỷ nguyên trí tuệ nhân tạo:

• Y Combinator tiết lộ rằng 25% mã nguồn của YC W25 gần như hoàn toàn được tạo ra bởi trí tuệ nhân tạo.5

• 15+ công ty AI-native đã mở rộng đến doanh thu hàng chục triệu USD trong vòng 1-2 năm với ít hơn 50 nhân viên.6

• Chi phí phát triển phần mềm đang tiến gần đến con số không khi AI có thể tạo ra toàn bộ hệ thống chức năng.

Điều này tạo ra nhiều cơ hội thú vị:

- Người sáng lập đơn độc với vốn 100 triệu đô la bây giờ đã trở thành điều có thể: Tôi biết những người sáng lập là chuyên gia trong lĩnh vực và đang xây dựng doanh nghiệp với doanh thu hàng năm 3-5 triệu đô la mà không cần nhân viên nào bằng cách tận dụng trí tuệ nhân tạo.

- Hiệu suất vốn đã tăng vọt: Các công ty cần 3 triệu đô la để khởi đầu vào năm 2020 giờ đây chỉ cần 100 nghìn đô la là đã có thể khởi đầu được.

- Thời gian đưa sản phẩm ra thị trường đã giảm: Các công ty AI-native có thể đạt được thị trường trong vài tuần, không phải là tháng hoặc năm.

- ACVs cao hơn nhiều so với SaaS truyền thống: Dịch vụ AI kích hoạt có thể được định giá dựa trên kết quả thay vì theo số chỗ ngồi. Chúng đánh bắt phần lương của ngân sách của một công ty, mà cao gấp nhiều lần so với ngân sách phần mềm.

- Con đường tới lợi nhuận chưa bao giờ dễ dàng hơn: Lịch sử cho thấy, lương thường là chi phí lớn nhất đối với các doanh nghiệp khởi nghiệp, chiếm 70-80% vốn đầu tư.

Các công ty AI-native hiện nay có thể hoạt động mà không cần nhân viên hoặc thậm chí không có nhân viên, đạt được lợi nhuận 80%+ ngay từ ngày đầu tiên thay vì phải tiêu tiền mặt trong nhiều năm để thuê đội ngũ lớn.

Cuối cùng, với việc gắn hạt giống, bạn vẫn duy trì tính linh hoạt và sự lựa chọn để theo đuổi các con đường khác sau này (dòng tiền, bán, huy động vốn từ VC, v.v.), vì vậy thực sự không có hậu quả tiêu cực nào.

Bốn người mẫu đối đầu: So sánh trung thực một cách tàn nhẫn

Hãy để tôi phân tích cụ thể cách mà những mô hình này hoạt động trên các chỉ số thực sự quan trọng đối với các nhà sáng lập và nhà đầu tư.

1. Tăng trưởng doanh thu + Quỹ tiếp tục đầu tư

Tại sao việc trồng giống thành công là quan trọng:

Nó kết hợp những điều tốt nhất từ cả hai thế giới: vốn ban đầu để thực hiện một cách tự do mà không lo lắng về việc hết tiền hoặc các vòng gọi vốn lặp lại.

Bạn sẽ đạt được sự phát triển nhanh hơn so với việc tự cung cấp vốn với một nền kinh tế bền vững mà các nhà sáng lập được hỗ trợ bởi các nhà đầu tư VC chỉ mơ ước.

2. Sự giảm tỷ lệ sở hữu của người sáng lập & Kiểm soát về quyền sở hữu

Tại sao việc trồng giống dẫn đầu:

Đó là mô hình duy nhất mà các nhà sáng lập có thể thực sự tăng sở hữu của họ theo thời gian thông qua việc mua lại đều đặn.

Bạn nhận được lợi ích vốn đầu tư mà không cần phải chịu đựng sự pha loãng không ngừng từ VC.

Bạn duy trì quyền kiểm soát chiến lược của số phận công ty của bạn.

Đó là sự cân bằng hoàn hảo giữa sở hữu và đòn bẩy.

3. Thành lập thanh khoản (Tiền trong TÚI CỦA BẠN)

Tại sao việc đeo dây giữ hạt giống chiến thắng:

Đây là mô hình duy nhất luôn ưu tiên đặt tiền vào túi của những người sáng lập, ngay cả từ những giai đoạn đầu tiên.

Trong khi những người sáng lập khác đặt cược nhiều năm cuộc đời của mình hy vọng có một kết quả 'thần thoại' mà thường không bao giờ xảy ra, những người dùng vốn khởi đầu xây dựng tài sản cá nhân ý nghĩa hàng năm thông qua việc phân phối lợi nhuận.

Đó là sự tự do tài chính mà không cần phải bán công ty của bạn hoặc phụ thuộc vào một sự kiện bên ngoài.

4. Lợi Nhuận của Nhà Đầu Tư & Thanh Khoản

Tại sao việc thắt dây giữ hạt giống thành công:

Seed-strapping tạo ra một sự cân đối đôi bên đều có lợi giữa những người sáng lập và nhà đầu tư mà các mô hình khác không thể sánh kịp.

Nhà đầu tư có thể nhận được lợi nhuận lỏng lẻo sớm và ổn định thay vì phải đợi một thập kỷ cho một phần thưởng không lỏng lẻo và rất không chắc chắn.

Sự cân chỉnh này có nghĩa là nhà đầu tư ủng hộ sự phát triển bền vững thay vì đẩy mạnh việc thoát khỏi sớm hoặc các vòng gọi vốn không cần thiết (động cơ của họ thực sự phù hợp với của bạn).

Tóm tắt về bốn mô hình:

Hiện thực tâm lý

Điều quan trọng hơn số liệu là sự khác biệt về tâm lý:

Người khởi nghiệp thường cảm thấy bị bẫy bởi “thành công” của mình. Họ đã tạo ra những công việc mà họ không thể bỏ được.

Những người sáng lập được hậu thuẫn bởi quỹ VC báo cáo mức độ căng thẳng cao nhất, luôn đuổi theo sự phát triển trong khi lo sợ sẽ hết tiền.

Boot-scalers mô tả một “tàu lượn” của sự đấu tranh ban đầu theo sau bởi áp lực để chứng minh đầu tư PE lớn.

Người trồng giống thường báo cáo sự hài lòng, tự do và kiểm soát cao nhất, đồng thời duy trì tính linh hoạt và sự lựa chọn để theo đuổi các con đường khác sau này (dòng tiền, bán, huy động vốn từ VC, v.v.)

Hướng đi AI-Native

Đối với các chuyên gia lĩnh vực xây dựng các công ty AI-native, seed-strapping cung cấp sự cân bằng lý tưởng:

- Vốn đủ để tận dụng công cụ AI hiệu quả

- Tối thiểu/không pha loãng bảo toàn sở hữu của người sáng lập

- Lối đi nhanh đến lợi nhuận cá nhân

- Khả năng tăng trưởng hợp thành mà không cần dùng đến bẫy của VC

- Cơ hội xây dựng một công ty tỷ đô với một người khi rào cản về quy mô sụp đổ

- Linh hoạt và sự lựa chọn để tiếp tục theo đuổi các con đường khác sau này (dòng tiền, bán, huy động vốn từ VC, vv)

Nếu bạn là một người sáng lập (hoặc một người muốn trở thành người sáng lập), tôi rất khuyến khích bạn xem xét việc xây dựng các công ty AI-native và áp dụng mô hình tài trợ seed-strapping.

Nếu bạn quan tâm đến việc tìm hiểu thêm về những người sáng lập như vậy và các công ty lean, có lợi nhuận mà họ đang xây dựng, hãy nhìn vào Bảng xếp hạng Lean AI chính thứcTôi đã tạo.

Tuyên bố:

- Bài viết này được sao chép từ [ henrythe9th]. Tất cả bản quyền thuộc về tác giả gốc [Henry Shi]. Nếu có bất kỳ khiếu nại nào về việc tái in này, vui lòng liên hệ Gate Họcđội, và họ sẽ xử lý nhanh chóng.

- Tuyên bố từ chối trách nhiệm: Các quan điểm và ý kiến được thể hiện trong bài viết này hoàn toàn thuộc về tác giả và không đại diện cho bất kỳ lời khuyên đầu tư nào.

- Bản dịch của bài viết sang các ngôn ngữ khác được thực hiện bởi nhóm Gate Learn. Trừ khi được đề cập, việc sao chép, phân phối hoặc đạo văn bản dịch là không được phép.

Bài viết liên quan

Tronscan là gì và Bạn có thể sử dụng nó như thế nào vào năm 2025?

Coti là gì? Tất cả những gì bạn cần biết về COTI

Stablecoin là gì?

Mọi thứ bạn cần biết về Blockchain

Thanh khoản Farming là gì?