Emilyvuong

No content yet

emilyvuong

🚨 #MetaMask# launches stablecoin mUSD instead of launching a separate token as rumored.

📌 Instead of launching the $MASK token as the market predicted, @MetaMask has chosen to launch the native stablecoin $mUSD. This is a strategic move: the stablecoin creates sustainable cash flow from reserve interest (cash + T-bill), building a sustainable ecosystem instead of burning short-term narratives.

📌 mUSD will be integrated directly into the wallet, on-ramp, swap, bridge, and real-world spending through MetaMask Card ( combined with #Mastercard). MetaMask clearly shows its direction of transform

View Original📌 Instead of launching the $MASK token as the market predicted, @MetaMask has chosen to launch the native stablecoin $mUSD. This is a strategic move: the stablecoin creates sustainable cash flow from reserve interest (cash + T-bill), building a sustainable ecosystem instead of burning short-term narratives.

📌 mUSD will be integrated directly into the wallet, on-ramp, swap, bridge, and real-world spending through MetaMask Card ( combined with #Mastercard). MetaMask clearly shows its direction of transform

- Reward

- like

- Comment

- Repost

- Share

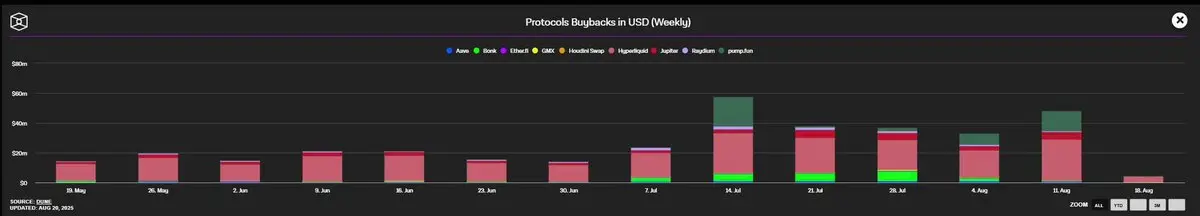

🚀 Buyback is silently becoming the new standard of crypto projects.

📌 In the last 3 months, the buyback token value of projects with revenue has skyrocketed from ~$20M/week to a peak of ~$55–60M/week.

- Hyperliquid: ~$24M/week, with even a buyback of $8M in just 24 hours.

- pumpfun: >$10M/week, cumulative has ~$30M+.

- Projects in the Solana eco, Aave, GMX, Houdini Swap... are also continuously buying back tokens.

📌 With this buyback volume, it has not yet significantly impacted the reduction of free float in the market, but this is a message saying "we will continuously support the price,"

View Original📌 In the last 3 months, the buyback token value of projects with revenue has skyrocketed from ~$20M/week to a peak of ~$55–60M/week.

- Hyperliquid: ~$24M/week, with even a buyback of $8M in just 24 hours.

- pumpfun: >$10M/week, cumulative has ~$30M+.

- Projects in the Solana eco, Aave, GMX, Houdini Swap... are also continuously buying back tokens.

📌 With this buyback volume, it has not yet significantly impacted the reduction of free float in the market, but this is a message saying "we will continuously support the price,"

- Reward

- like

- Comment

- Repost

- Share

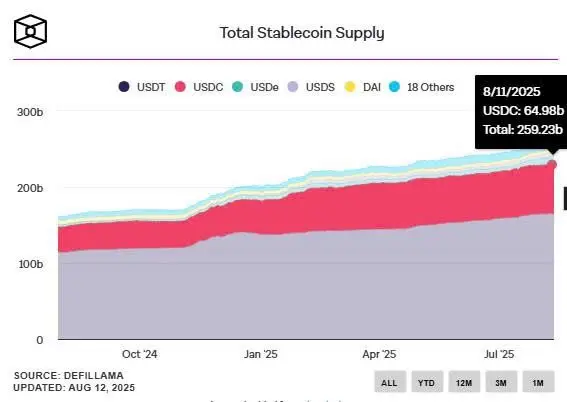

📍Rumor from Reuters: China is researching the issuance of the NEO stablecoin on CYN.

🔶USD is gradually losing its dominance based on the SWIFT system as more and more countries participate in the trend of de-dollarization.

The US government hastily approved the Genius Act not out of love for cryptocurrency, but to increase a large demand for US government bonds + efforts to strengthen the influence of the USD again through USD-pegged stablecoins.

🔶1 stablecoin is issued equivalent to 1 USD and is participating in the global trading network ( without needing to go through SWIFT). The market

View Original🔶USD is gradually losing its dominance based on the SWIFT system as more and more countries participate in the trend of de-dollarization.

The US government hastily approved the Genius Act not out of love for cryptocurrency, but to increase a large demand for US government bonds + efforts to strengthen the influence of the USD again through USD-pegged stablecoins.

🔶1 stablecoin is issued equivalent to 1 USD and is participating in the global trading network ( without needing to go through SWIFT). The market

- Reward

- like

- Comment

- Repost

- Share

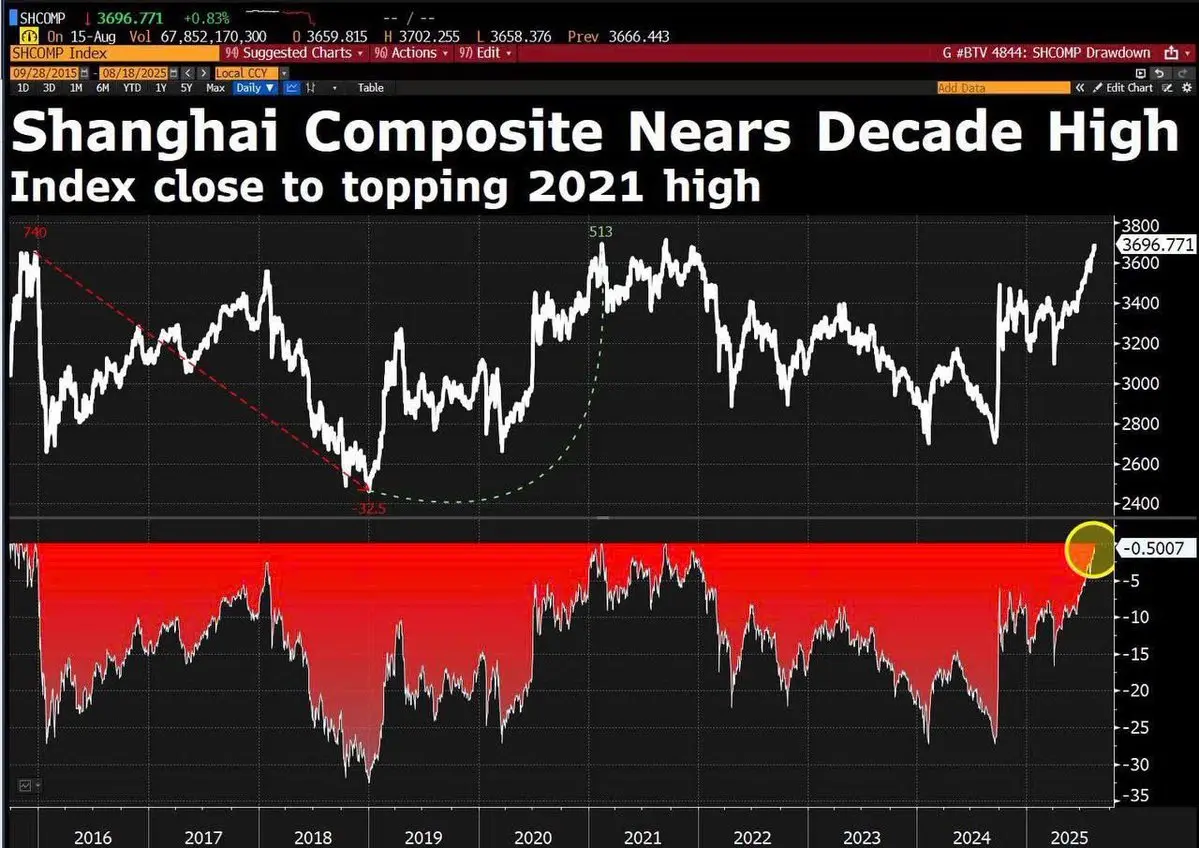

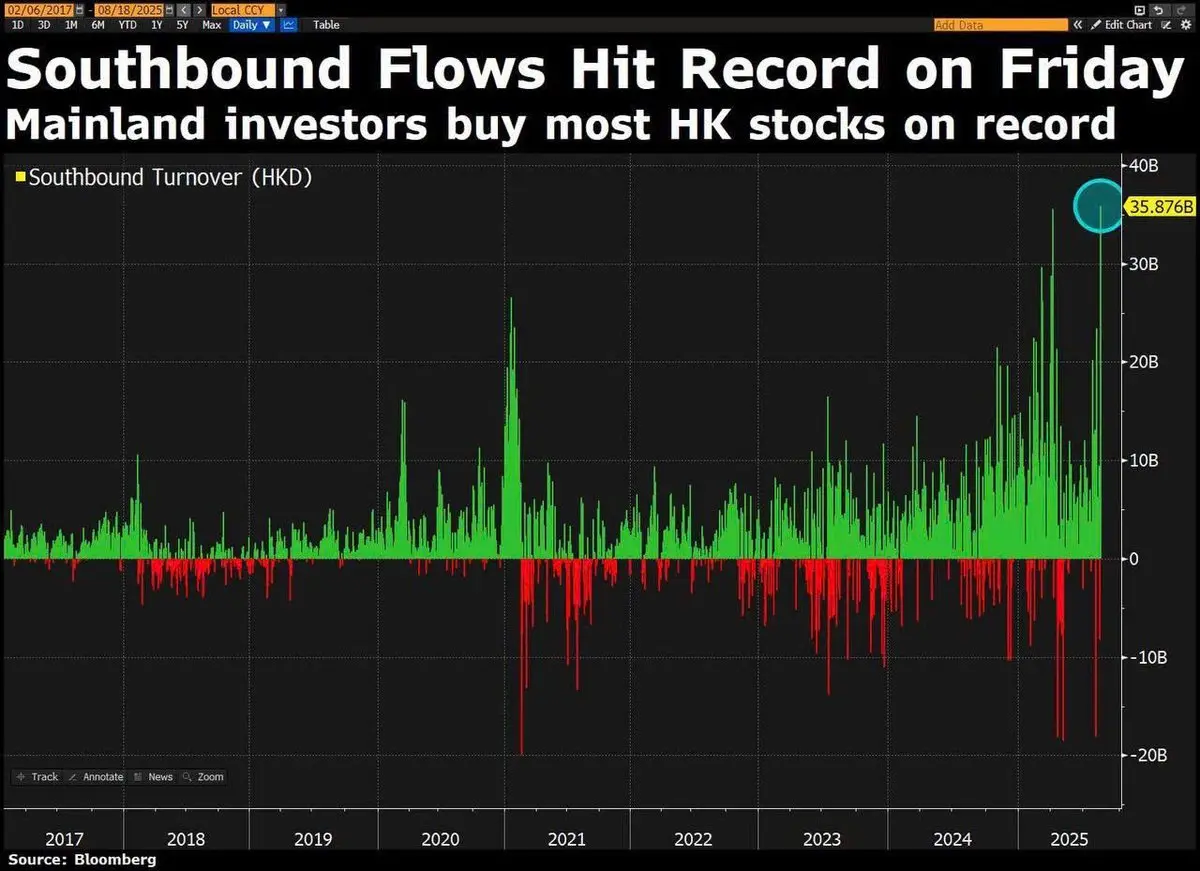

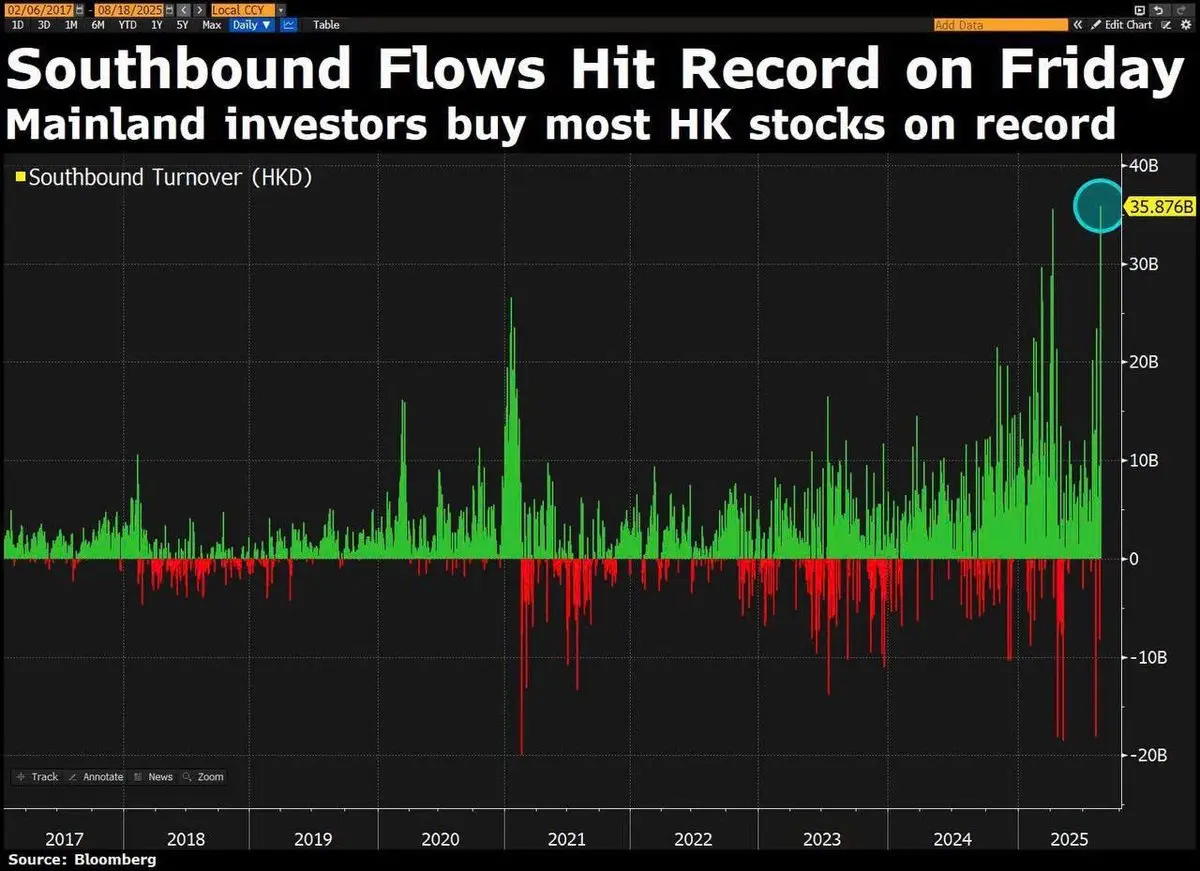

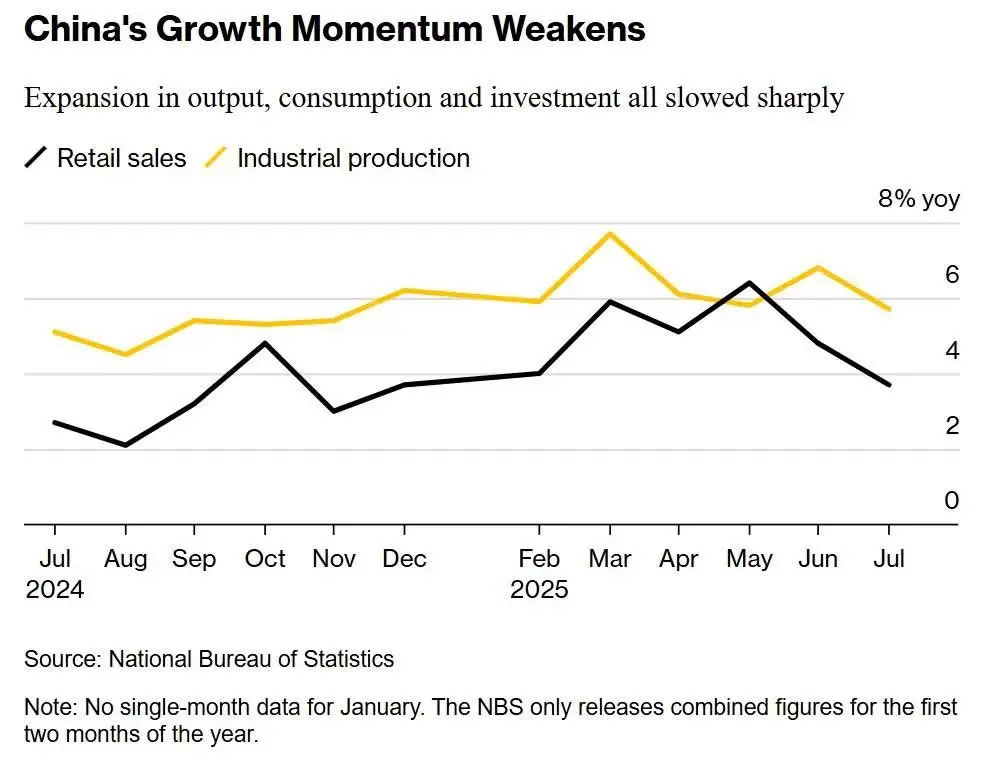

📍Beijing will soon have to rescue the $11,000 billion stock market.

📌Context: the economy is slowing down sharply, the real estate ( which once accounted for over 30% of household assets ) is collapsing, consumer confidence has fallen to its lowest level in over 20 years. If the stock market – where financial assets are valued – does not restore the hope of becoming "rich" again, then people will still... hold defensive cash → the economy falls into a liquidity trap and the "defensive mentality" persists.

🚨 Why can't the Chinese stock market "wake up" by itself?

- After the crash in 2015, t

View Original📌Context: the economy is slowing down sharply, the real estate ( which once accounted for over 30% of household assets ) is collapsing, consumer confidence has fallen to its lowest level in over 20 years. If the stock market – where financial assets are valued – does not restore the hope of becoming "rich" again, then people will still... hold defensive cash → the economy falls into a liquidity trap and the "defensive mentality" persists.

🚨 Why can't the Chinese stock market "wake up" by itself?

- After the crash in 2015, t

- Reward

- like

- Comment

- Repost

- Share

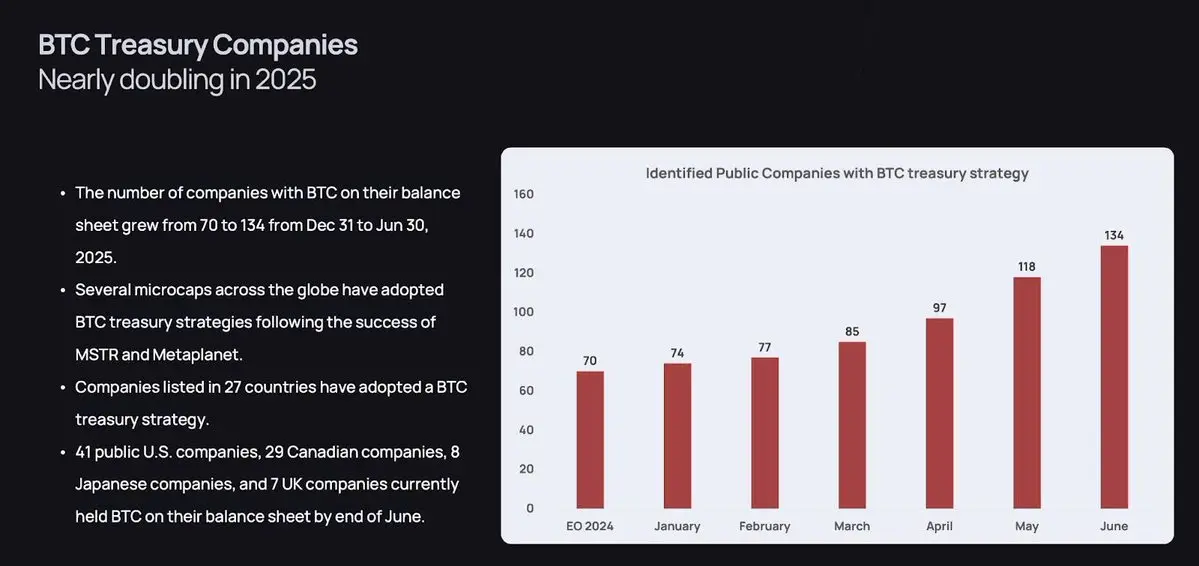

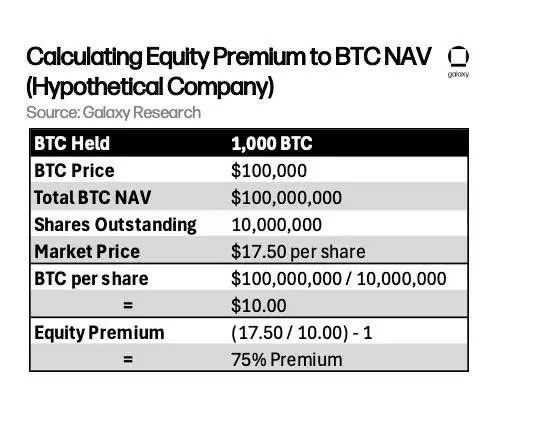

📍The wave of Asian businesses shifting their balance sheets to Bitcoin

📌 In just the first 6 months of 2025, the number of listed companies in Asia holding BTC surged from 70 to 134 (, holding over 244K BTC), making Bitcoin treasury the hottest investment trend in the region. Notable cases: Metaplanet (Japan) wants to raise $5.4B to acquire 210K BTC; Top Win (Taiwan), Quantum Solutions (Japan), K Wave Media (South Korea) are all raising funds to copy the Strategy.

📌 ETFs in these countries have not been approved → investors use the shares of these companies as a proxy to hold Bitcoin and en

View Original📌 In just the first 6 months of 2025, the number of listed companies in Asia holding BTC surged from 70 to 134 (, holding over 244K BTC), making Bitcoin treasury the hottest investment trend in the region. Notable cases: Metaplanet (Japan) wants to raise $5.4B to acquire 210K BTC; Top Win (Taiwan), Quantum Solutions (Japan), K Wave Media (South Korea) are all raising funds to copy the Strategy.

📌 ETFs in these countries have not been approved → investors use the shares of these companies as a proxy to hold Bitcoin and en

- Reward

- like

- Comment

- Repost

- Share

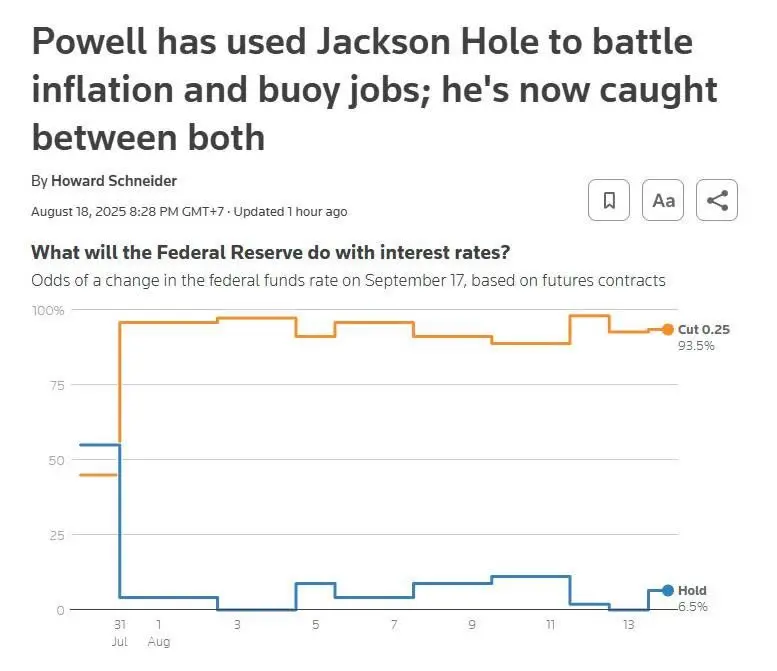

📍Jackson Hole this week, the day Powell decides: How the market is performing until the end of autumn

📌Expectations for a rate cut in September are rising to ~85%, but Powell is likely not to provide Wall Street with a clear answer – instead, it will be a message along the lines of "it still depends on the data."

📌The market is in a risk-on state as Asian stocks inch up, the USD cools down, and oil prices drop, not yet enough certainty that the Fed will soften its tone in Jackson Hole.

📌If Jackson Hole does not show dovish signals, the market could dump 7–15% in the remainder of the fall,

View Original📌Expectations for a rate cut in September are rising to ~85%, but Powell is likely not to provide Wall Street with a clear answer – instead, it will be a message along the lines of "it still depends on the data."

📌The market is in a risk-on state as Asian stocks inch up, the USD cools down, and oil prices drop, not yet enough certainty that the Fed will soften its tone in Jackson Hole.

📌If Jackson Hole does not show dovish signals, the market could dump 7–15% in the remainder of the fall,

- Reward

- 2

- Comment

- Repost

- Share

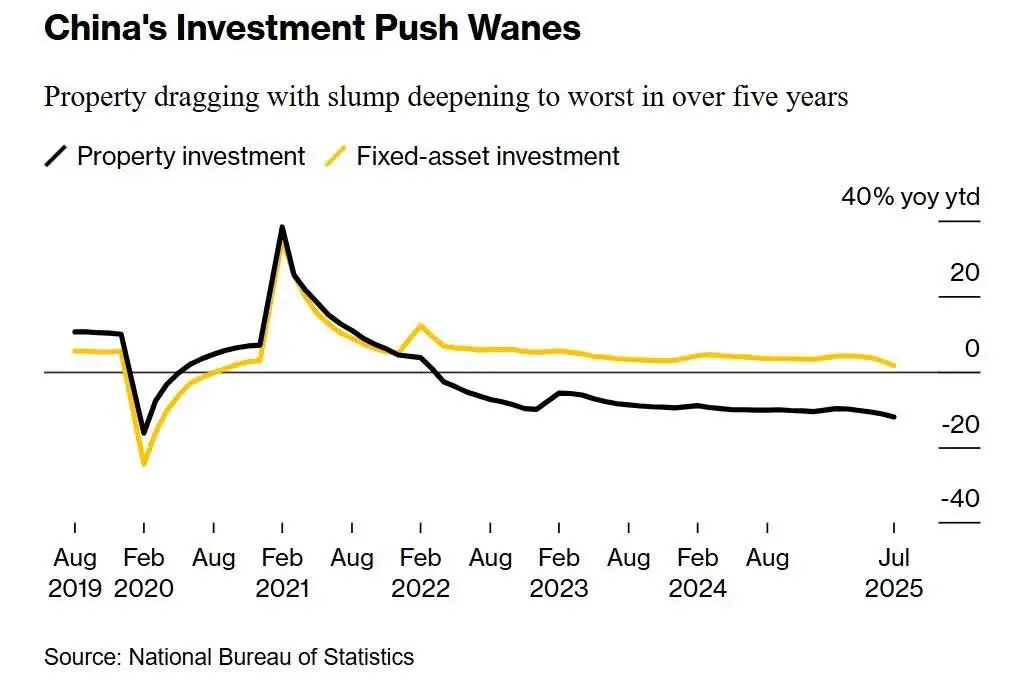

📉 The Chinese economy continues to falter due to increasing pressure from the trade war.

🔶Industrial output in July increased by only +5.7% YoY, lower than the forecast of +6.0% and the +6.8% of June.

–> Production motivation is rapidly declining due to labor exports.

🔶 Retail sales dropped to +3.7% YoY, the lowest since January 2025, below the expectation of +4.6%

Household consumer sentiment remains defensive, signaling the health of the labor market and expectations for future income.

🔶 Fixed asset investment increased by only +1.6% YoY, the lowest since March 2020, mainly due to real

View Original🔶Industrial output in July increased by only +5.7% YoY, lower than the forecast of +6.0% and the +6.8% of June.

–> Production motivation is rapidly declining due to labor exports.

🔶 Retail sales dropped to +3.7% YoY, the lowest since January 2025, below the expectation of +4.6%

Household consumer sentiment remains defensive, signaling the health of the labor market and expectations for future income.

🔶 Fixed asset investment increased by only +1.6% YoY, the lowest since March 2020, mainly due to real

- Reward

- 2

- Comment

- 1

- Share

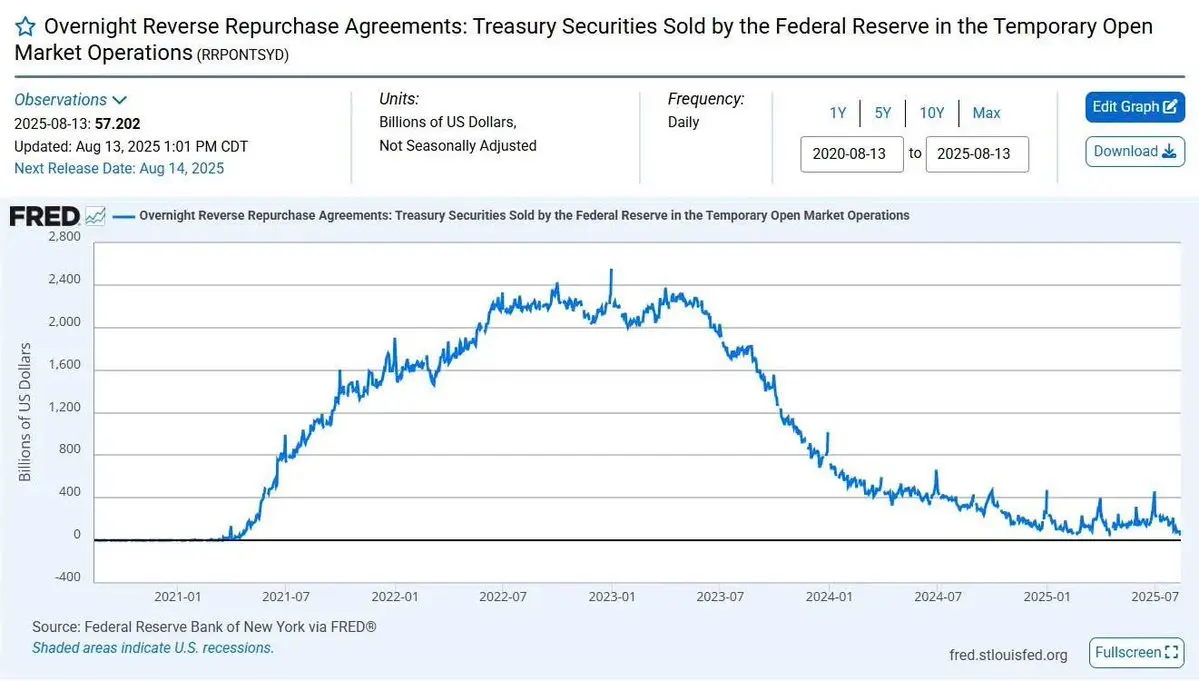

📍 Reverse Repo at the Fed bottom out 4 years

📌 The Reverse Repo balance (RRP) on August 13 is only $28.8B - the lowest level since 2021. RRP is the cash reserve of banks at the Fed, where they deposit money overnight to receive the floor interest rate outside the free market.

📌 Since the outbreak of COVID, RRP has ballooned to over $2,000B due to excess liquidity, but has now returned to a state of depletion:

- The short-term liquidity reserves of the banking system are almost depleted.

- The Fed has lost a "vent" to temporarily suck some money out of the market.

- The interest rates in the

View Original📌 The Reverse Repo balance (RRP) on August 13 is only $28.8B - the lowest level since 2021. RRP is the cash reserve of banks at the Fed, where they deposit money overnight to receive the floor interest rate outside the free market.

📌 Since the outbreak of COVID, RRP has ballooned to over $2,000B due to excess liquidity, but has now returned to a state of depletion:

- The short-term liquidity reserves of the banking system are almost depleted.

- The Fed has lost a "vent" to temporarily suck some money out of the market.

- The interest rates in the

- Reward

- like

- Comment

- Repost

- Share

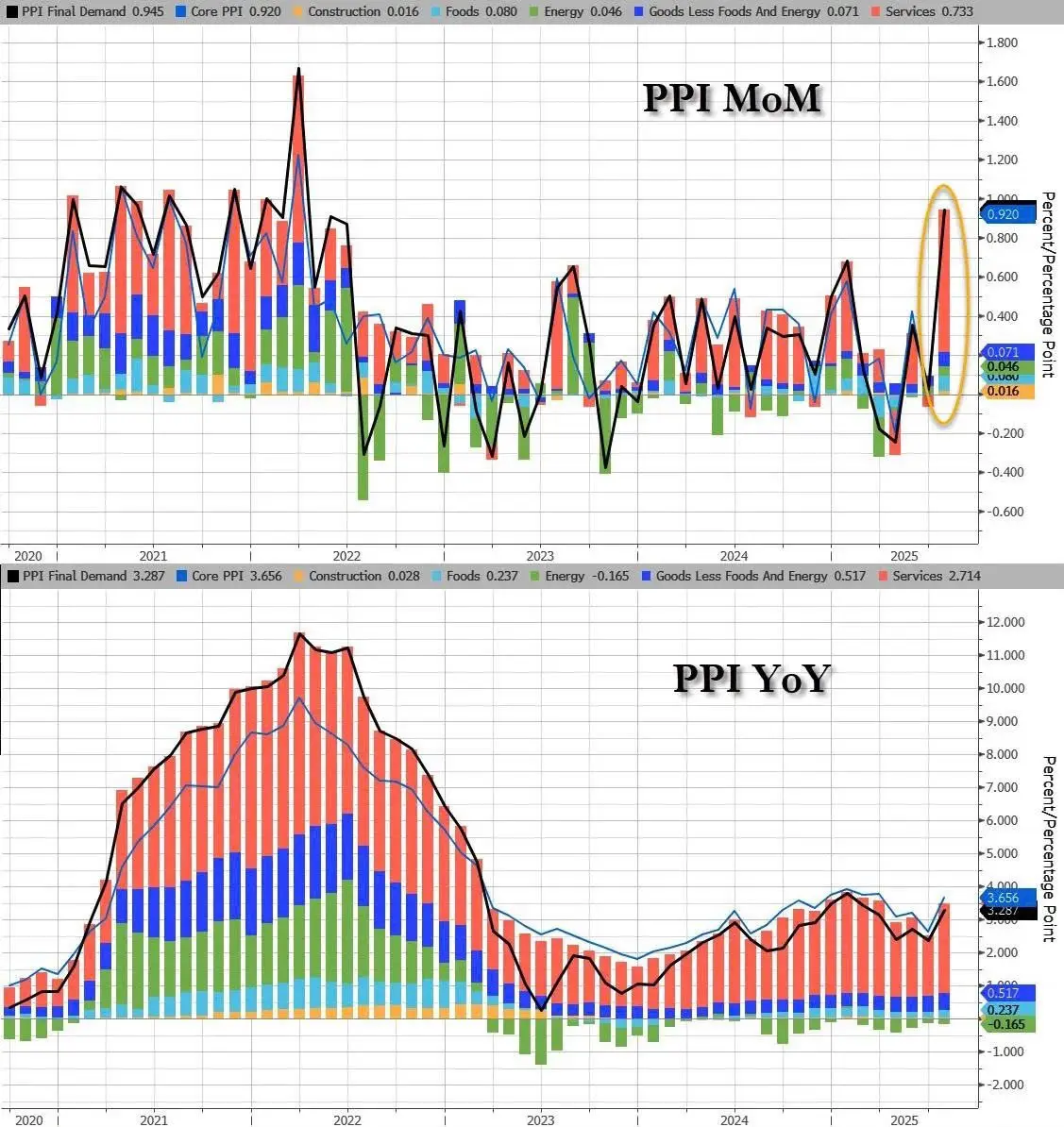

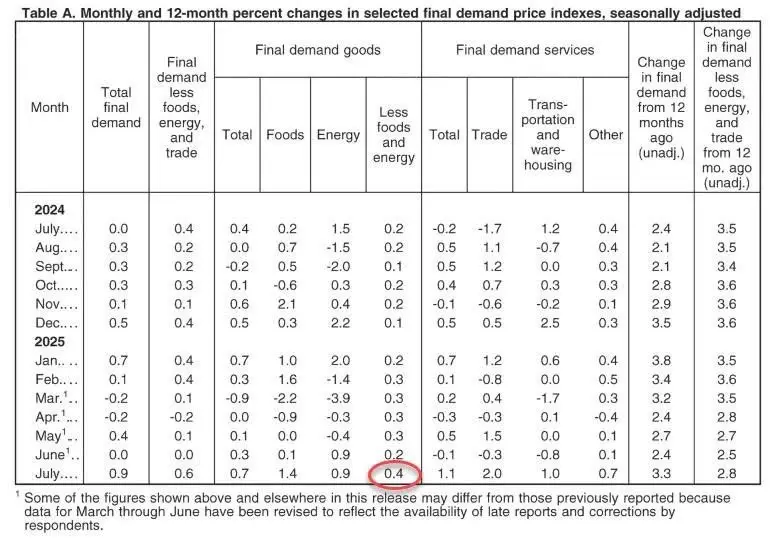

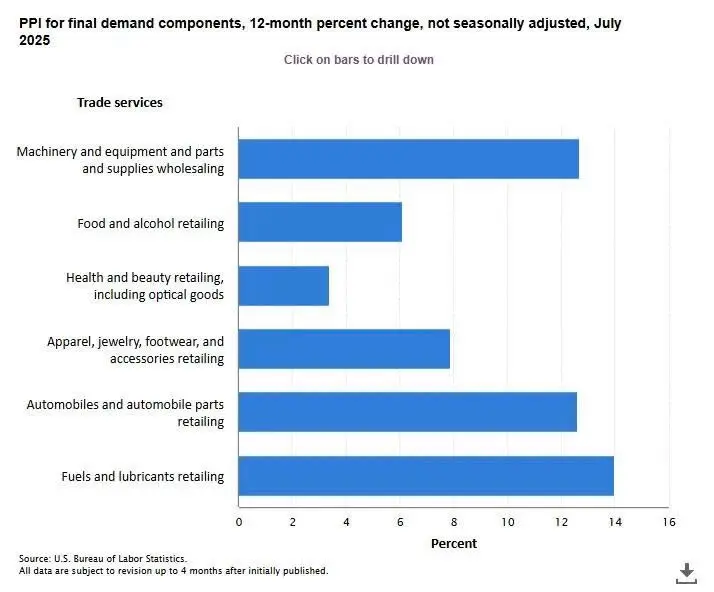

📍 PPI America increased 4 times the forecast - Tariffs are not the culprit yet.

📌 July data:

- PPI YoY: +3.3% ( forecast +2.5% ), the highest since 02/2025.

- PPI MoM: +0.9% - the strongest since 06/2022.

- Core PPI YoY: +3.7% ( forecast +2.9%), highest since 03/2023.

- PPI services MoM: +1.1% - the highest since 03/2022, pulling the entire PPI up.

📌 Reason:

- Energy rebounded thanks to July oil prices.

- Goods: Vegetable and fruit prices increased by 38.5% MoM, mainly due to the policy of expelling illegal immigrant workers leading to a shortage of labor for harvesting and processing goods

View Original📌 July data:

- PPI YoY: +3.3% ( forecast +2.5% ), the highest since 02/2025.

- PPI MoM: +0.9% - the strongest since 06/2022.

- Core PPI YoY: +3.7% ( forecast +2.9%), highest since 03/2023.

- PPI services MoM: +1.1% - the highest since 03/2022, pulling the entire PPI up.

📌 Reason:

- Energy rebounded thanks to July oil prices.

- Goods: Vegetable and fruit prices increased by 38.5% MoM, mainly due to the policy of expelling illegal immigrant workers leading to a shortage of labor for harvesting and processing goods

- Reward

- like

- Comment

- Repost

- Share

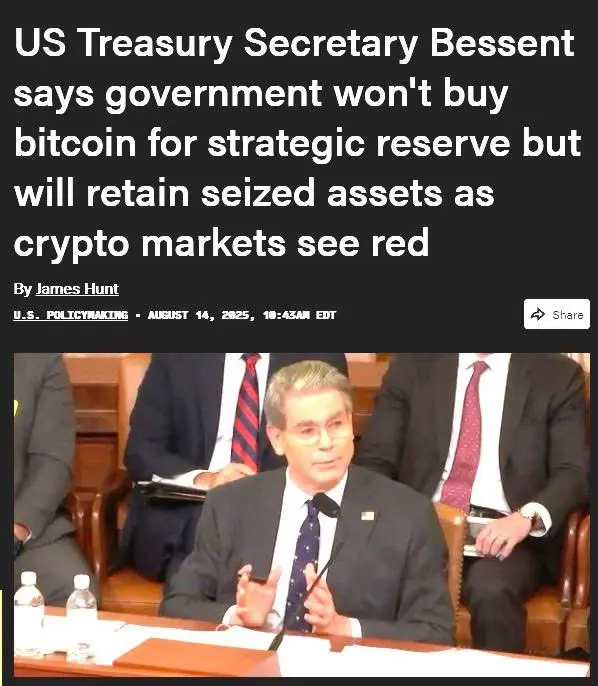

📍Mr. Bessent: The government will not spend money to buy more BTC for the strategic reserve fund.

📌 The U.S. Secretary of the Treasury announced that the U.S. will not purchase any more $BTC but will only use the Bitcoin seized from cases to hold as national assets. The current estimated scale of $BTC in the reserve is $15–20B, but this message is more symbolic than an economic lever. BTC is being included in the national reserves - but will the White House spend money to buy it??

📌 The market is disheartened by this news, BTC dropped 5% as hopes that the government would buy more $BTC were

View Original📌 The U.S. Secretary of the Treasury announced that the U.S. will not purchase any more $BTC but will only use the Bitcoin seized from cases to hold as national assets. The current estimated scale of $BTC in the reserve is $15–20B, but this message is more symbolic than an economic lever. BTC is being included in the national reserves - but will the White House spend money to buy it??

📌 The market is disheartened by this news, BTC dropped 5% as hopes that the government would buy more $BTC were

- Reward

- like

- Comment

- Repost

- Share

🟧The goal of Circle when launching Layer1 - Arc: Is it simply to compete with Tether?

🔶Circle has just announced the launch of Arc - a Layer 1 EVM-compatible blockchain, where USDC officially becomes the gas token, integrating an FX engine system and near real-time settlement capabilities. USDC is set as the central currency, with all transactions, liquidity, and financial communications converging to USDC.

🔶Q2 2025 Circle's financial results surged thanks to the "east wind" IPO:

- Circulating supply increased by 90% YoY, reaching approximately $61–65B.

- Total revenue from reserves and ser

View Original🔶Circle has just announced the launch of Arc - a Layer 1 EVM-compatible blockchain, where USDC officially becomes the gas token, integrating an FX engine system and near real-time settlement capabilities. USDC is set as the central currency, with all transactions, liquidity, and financial communications converging to USDC.

🔶Q2 2025 Circle's financial results surged thanks to the "east wind" IPO:

- Circulating supply increased by 90% YoY, reaching approximately $61–65B.

- Total revenue from reserves and ser

- Reward

- like

- 1

- Repost

- Share

GateUser-4666a854 :

:

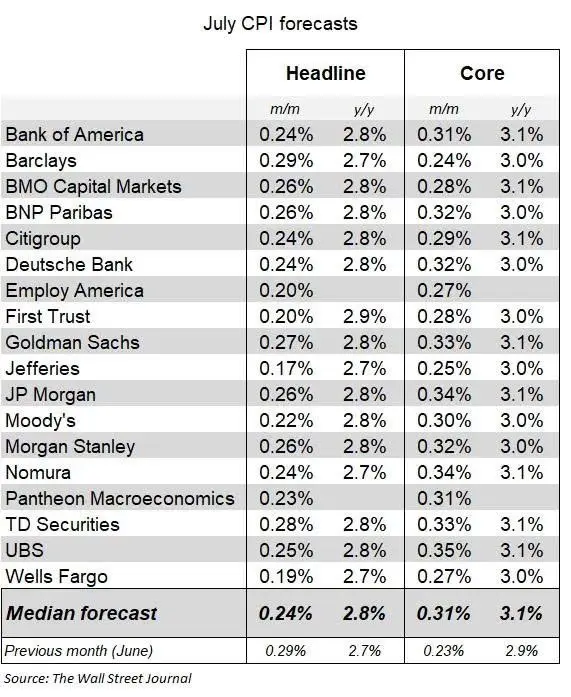

Take off with strength 🚀📍What to see from the July CPI forecast of financial institutions

📌 Headline CPI (m/m) median forecast at 0.24% (y/y 2.8%), down from June (0.29% m/m, 2.7% y/y).

Shows that overall inflation expectations are easing slightly month by month.

📌 Core CPI ( m/m ) median forecast 0.31% ( y/y 3.1% ), higher than June ( 0.23% m/m, 2.9% y/y ).

Although energy and food prices may stabilize, Core CPI is still likely under pressure from service and housing groups ( that have been maintained since the beginning of 2025).

📌 Notable discrepancy in forecasts:

- Jefferies forecasts the lowest for Headlin

View Original📌 Headline CPI (m/m) median forecast at 0.24% (y/y 2.8%), down from June (0.29% m/m, 2.7% y/y).

Shows that overall inflation expectations are easing slightly month by month.

📌 Core CPI ( m/m ) median forecast 0.31% ( y/y 3.1% ), higher than June ( 0.23% m/m, 2.9% y/y ).

Although energy and food prices may stabilize, Core CPI is still likely under pressure from service and housing groups ( that have been maintained since the beginning of 2025).

📌 Notable discrepancy in forecasts:

- Jefferies forecasts the lowest for Headlin

- Reward

- like

- Comment

- Repost

- Share

📍Trump extends the tariff ceasefire with China for another 90 days

📌 President Trump has just signed a decree extending the "truce" on tariffs with China for an additional 90 days, pushing the deadline for new tariffs to 9/11/2025. The current tariff rate of 30% remains unchanged, instead of activating the previously prepared "three-digit tariffs."

📌 The White House wants to maintain stability in order to have time to address internal issues before pushing for progress in negotiations. Negotiations in Geneva, London, and Stockholm have reduced tariffs on Chinese goods from 145% to 30% and o

View Original📌 President Trump has just signed a decree extending the "truce" on tariffs with China for an additional 90 days, pushing the deadline for new tariffs to 9/11/2025. The current tariff rate of 30% remains unchanged, instead of activating the previously prepared "three-digit tariffs."

📌 The White House wants to maintain stability in order to have time to address internal issues before pushing for progress in negotiations. Negotiations in Geneva, London, and Stockholm have reduced tariffs on Chinese goods from 145% to 30% and o

- Reward

- like

- Comment

- Repost

- Share

📍 Notable macro week: The focus is on U.S. CPI data

📌 12/8 – CPI & Core CPI for July of the US

- This is the key data for this week, which may determine the next direction of the Fed. If inflation cools down, expectations for interest rate cuts will rise; conversely, higher-than-expected data will reinforce the stance of keeping interest rates.

📌 14/8 – PPI for July of the US

- US PPI ( for July 7): indicates price pressure from the production side - often leading the CPI trend in the upcoming months.

📌 15/8 – Retail Sales & Consumer Sentiment (USA)

- Retail sales: Measure the purchasing p

View Original📌 12/8 – CPI & Core CPI for July of the US

- This is the key data for this week, which may determine the next direction of the Fed. If inflation cools down, expectations for interest rate cuts will rise; conversely, higher-than-expected data will reinforce the stance of keeping interest rates.

📌 14/8 – PPI for July of the US

- US PPI ( for July 7): indicates price pressure from the production side - often leading the CPI trend in the upcoming months.

📌 15/8 – Retail Sales & Consumer Sentiment (USA)

- Retail sales: Measure the purchasing p

- Reward

- like

- Comment

- Repost

- Share

📍China's move to curb the development of stablecoins: It's not about crypto, but about anti-dollarization.

👉🏻Although Beijing has banned most crypto activities since 2021, OTC trading is still thriving and even accelerating. In the first 3 quarters of 2024, OTC trading in China reached ~$75B, with Q2/2024 hitting $23.7B, the highest level in 3 years.

✨This is concerning for Beijing as USD-pegged stablecoin flows into the economy, bringing along the risk of dollarization - something that China and BRICS are striving to combat.

✨Chinese authorities have requested that securities firms and aca

View Original👉🏻Although Beijing has banned most crypto activities since 2021, OTC trading is still thriving and even accelerating. In the first 3 quarters of 2024, OTC trading in China reached ~$75B, with Q2/2024 hitting $23.7B, the highest level in 3 years.

✨This is concerning for Beijing as USD-pegged stablecoin flows into the economy, bringing along the risk of dollarization - something that China and BRICS are striving to combat.

✨Chinese authorities have requested that securities firms and aca

- Reward

- like

- Comment

- Repost

- Share

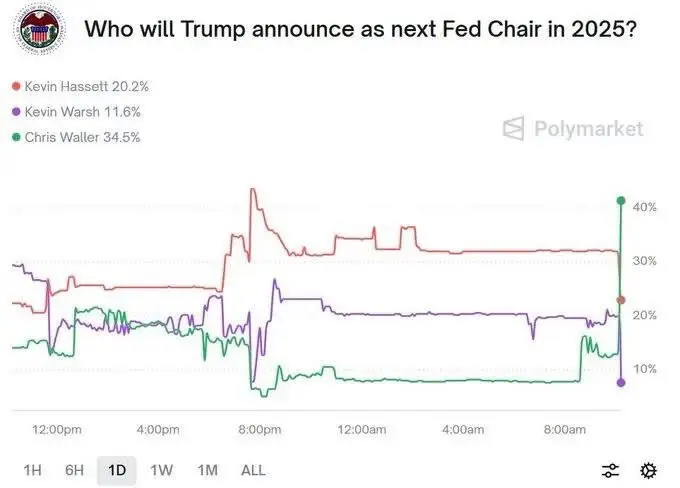

📍Trump narrows down the top 3 candidates to replace Powell: Waller is the most promising.

📌 After today's closed-door interview, Trump has narrowed down the list of candidates for the Fed chair position to Kevin Hassett (, former White House Economic Advisor), Kevin Warsh (, former Fed Governor), and Chris Waller (, current Fed Governor).

📌 Among them, Chris Waller is emerging as the top choice. He just had a face-to-face meeting with the Trump cabinet and is viewed as the "safest" candidate, familiar enough for the market to feel stable, has previously voted to cut interest rates, and meet

View Original📌 After today's closed-door interview, Trump has narrowed down the list of candidates for the Fed chair position to Kevin Hassett (, former White House Economic Advisor), Kevin Warsh (, former Fed Governor), and Chris Waller (, current Fed Governor).

📌 Among them, Chris Waller is emerging as the top choice. He just had a face-to-face meeting with the Trump cabinet and is viewed as the "safest" candidate, familiar enough for the market to feel stable, has previously voted to cut interest rates, and meet

- Reward

- like

- Comment

- Repost

- Share

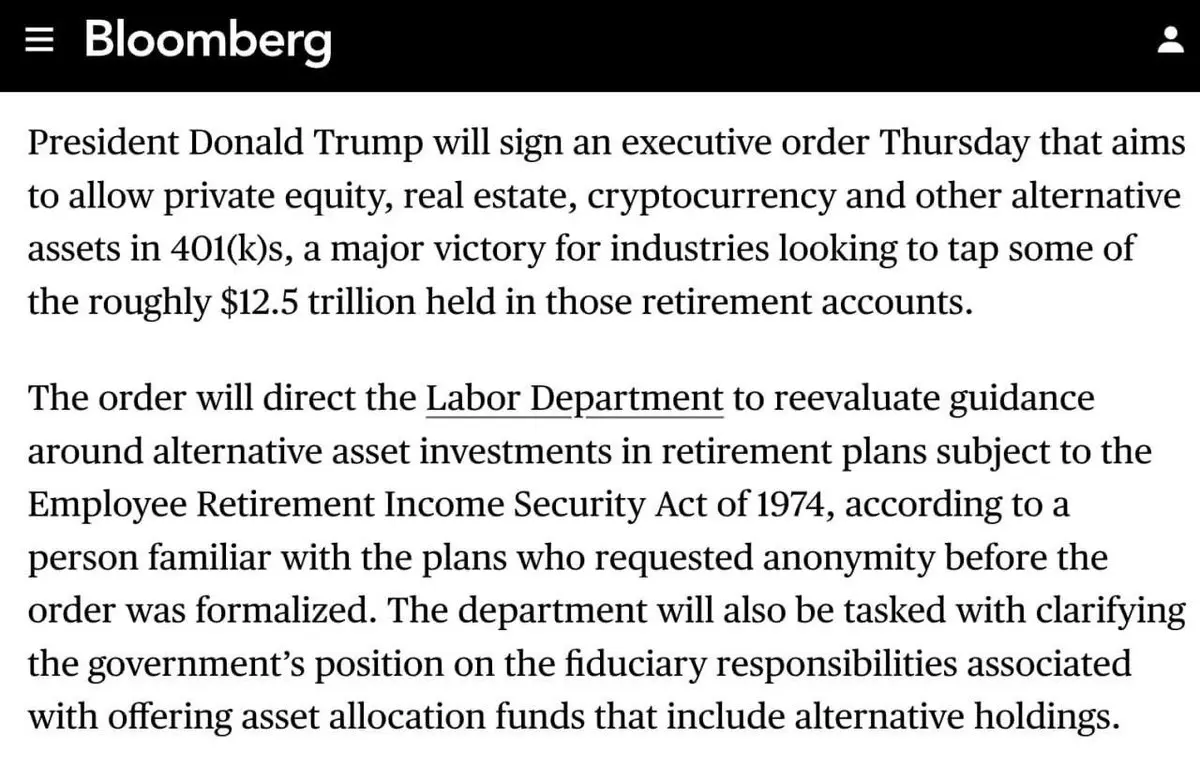

📍Trump opens the door 401(k) for crypto – Bitcoin ETF reversal attracts capital

📌 Trump is preparing to sign an executive order expanding the investment options for retirement accounts 401(k), allowing workers to allocate to alternative assets such as private equity, real estate, and crypto. This is an unprecedented move, legitimizing the flow of retirement funds into the digital currency market.

💭 If 401(k) is really signed, a stable long-term capital wave will flow into Bitcoin.

In the short term, there will be a huge influx of money into the market, but in the long term, if pension fund

View Original📌 Trump is preparing to sign an executive order expanding the investment options for retirement accounts 401(k), allowing workers to allocate to alternative assets such as private equity, real estate, and crypto. This is an unprecedented move, legitimizing the flow of retirement funds into the digital currency market.

💭 If 401(k) is really signed, a stable long-term capital wave will flow into Bitcoin.

In the short term, there will be a huge influx of money into the market, but in the long term, if pension fund

- Reward

- like

- Comment

- Repost

- Share

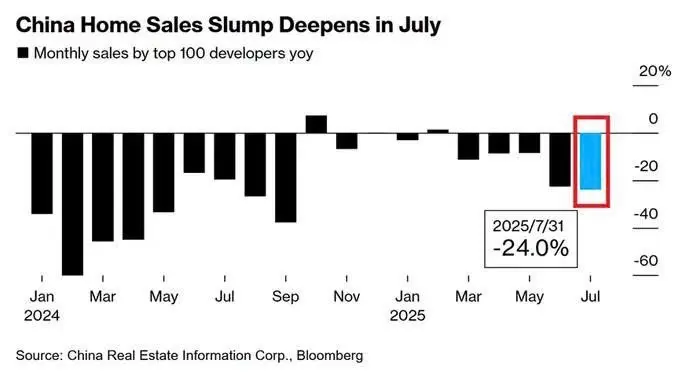

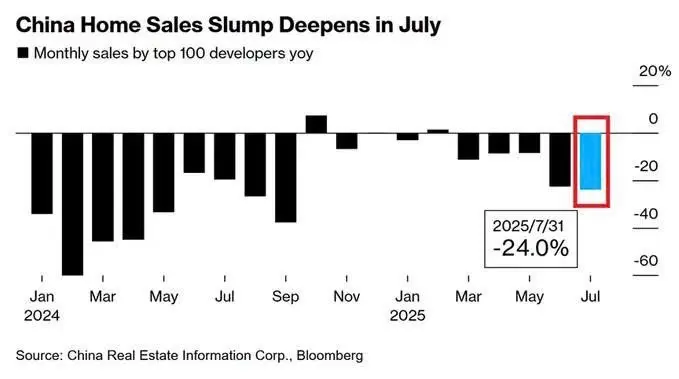

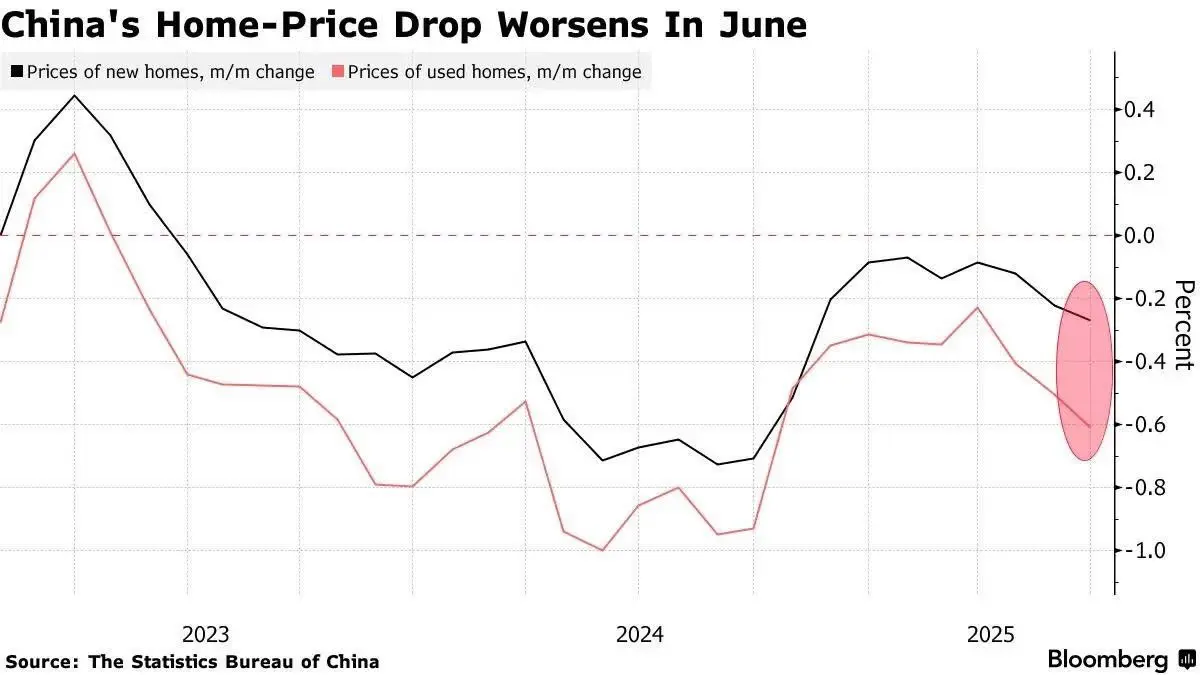

📍China's real estate continues to decline, the government's support packages only serve as "band-aids".

🔻 The sales of the 100 largest real estate companies in China decreased by -24% Y/Y in July (the lowest in 10 months). This figure follows a -23% decline from the previous month. Month-over-month, it dropped by -38% M/M (the lowest since the beginning of the year).

🔻 Both new and old home prices fell together in June, exceeding -0.5% M/M.

🔻 The PBoC continues to inject 544.8B CNY through a 7-day RRP with an interest rate of 1.4%. It is still just a temporary adjustment, not addressing th

🔻 The sales of the 100 largest real estate companies in China decreased by -24% Y/Y in July (the lowest in 10 months). This figure follows a -23% decline from the previous month. Month-over-month, it dropped by -38% M/M (the lowest since the beginning of the year).

🔻 Both new and old home prices fell together in June, exceeding -0.5% M/M.

🔻 The PBoC continues to inject 544.8B CNY through a 7-day RRP with an interest rate of 1.4%. It is still just a temporary adjustment, not addressing th

View Original

- Reward

- like

- Comment

- Repost

- Share

📍China's real estate continues to decline, the government's support packages only serve as "band-aids".

🔻 The sales of the 100 largest real estate companies in China decreased by -24% Y/Y in July (the lowest in 10 months). This figure follows a -23% decline from the previous month. Month-over-month, it dropped by -38% M/M (the lowest since the beginning of the year).

🔻 Both new and old home prices fell together in June, exceeding -0.5% M/M.

🔻 The PBoC continues to inject 544.8B CNY through a 7-day RRP with an interest rate of 1.4%. It is still just a temporary adjustment, not addressing th

🔻 The sales of the 100 largest real estate companies in China decreased by -24% Y/Y in July (the lowest in 10 months). This figure follows a -23% decline from the previous month. Month-over-month, it dropped by -38% M/M (the lowest since the beginning of the year).

🔻 Both new and old home prices fell together in June, exceeding -0.5% M/M.

🔻 The PBoC continues to inject 544.8B CNY through a 7-day RRP with an interest rate of 1.4%. It is still just a temporary adjustment, not addressing th

View Original

- Reward

- like

- Comment

- Repost

- Share